Dow Jones closes above 12,000 points for first time

SHOTLIST

1. Wide shot exterior of New York Stock Exchange building on Wall Street

2. Wide shot of New York Stock Exchange trading floor

3. Mid shot of traders on floor

4. SOUNDBITE (English) Alec Young, Equity Analyst, Standard & Poors:

“We’ve had a 25 percent pullback in crude oil prices. We’ve had lessened geopolitical tensions with an end to the Israeli Hezbollah conflict in the Middle East. We’ve had more benign inflation data, the Federal Reserve is now seen as being on hold, whereas before they were aggressively raising interest rates. All this is leading to more confidence and a soft landing for the US and global economies in 2007 and hence the belief that although earnings may slow a little, they’re still going to be fairly respectable and we think this increased confidence on the economic and earnings outlook is really what’s gotten us to Dow 12-thousand.”

5. Pan across NYSE trading floor

6. SOUNDBITE (English): Alec Young, Equity Analyst, Standard & Poors:

“As we look ahead to what to expect through year-end, we think that given that the markets are discounting a much rosier environment now then they were a couple of months ago, then it may be difficult for the market to make significant headway through year-end 2006. We’re still reasonably positive on 2007, we just think the market needs a little time to digest the big gains that it’s had. So we think we’ve probably seen the bulk of the advance for 2006, we may sort of trade sideways for the next couple of months.”

7. Mid shot traders on floor

8. Pan down exterior of NYSE building

STORYLINE:

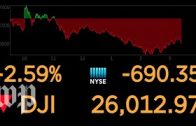

The Dow Jones industrial average scored its first close above 12,000 Thursday as Wall Street, undaunted despite evidence of a weaker economy, held fast to a slim advance.

The stock market’s most prominent benchmark ended the day at 12,011.73, the ninth time in just over two weeks that the Dow has achieved a record high close.

The record came one day after the index of 30 blue chip stocks made its first foray past 12,000.

The Dow’s latest milestone came on the anniversary of Black Monday in 1987, when the Dow plunged 508 points and also suffered its second-biggest percentage drop in history.

The Dow finished that day at 1,793.90, far from Thursday’s record.

The finish above 12,000 was the latest sign that the stock market continues a cautious recovery from the losses and despair investors suffered in the early part of this decade.

After peaking in early 2000, the Dow and other indexes fell precipitously amid the dot-com collapse, recession and the impact of the Sept. 11, 2001, terror attacks.

Still, trading was erratic Thursday, with the overall market struggling to sustain an advance after a pair of reports signalled the Federal Reserve might have a tougher time orchestrating a soft landing of the economy.

Disappointing earnings in the technology sector also weighed on stocks.

The Conference Board’s index of U.S. leading economic indicators rose less than forecast in September. Meanwhile, the Philadelphia Fed’s general economic index contracted for the first time since April 2003. The numbers rattled investors who had been sending stocks higher since

September on optimism the Fed might even cut rates in early 2007.

At the close, the Dow rose 19.05, or 0.16 percent. On Wednesday, the Dow rose as high as 12,049.51, which stands as its trading high; the index then fell back below 12,000 as many investors turned conservative and decided to cash in some profits.

You can license this story through AP Archive: http://www.aparchive.com/metadata/youtube/b42caf712e86ea3ff7ce4ca43edb15a9

Find out more about AP Archive: http://www.aparchive.com/HowWeWork